This post was originally published on Feb. 13, 2013, and updated on July 31, 2020.

Time to read: 4 minutes

Contract vs. Direct Hire Summary:

- Understanding the difference between contract and direct hire employment and why companies prefer one over the other clears the air for candidates.

- Key differences between the two types of employment come down to cost.

Article by Nancy DiSciullo, Profiles Senior Account Manager, Washington, DC

90 percent of Profiles’ clients are enterprise companies, however, job seekers we work with continue to be surprised that these larger companies are opting for contractors over full-time employees. Contract staffing still continues to be one big question mark for many candidates on the market. For some, having an end date tied to their job can bring on feelings of stress and uncertainty. In this article, we will break down each type of employment and answer the overarching question here: why do companies prefer to hire contractors instead of direct-hire employees?

Breaking down Contract Employment and Direct-Hire Employment

Contract Employment

Often referred to as temporary employment, contract hires or contractors are employed by the staffing company, which will distribute pay based on hours worked. The staffing company carries the burden, payroll, benefits, paid time off, and other human resources responsibilities. A contract position can still work up to 40 hours per week, which does include overtime pay, usually 1.5 times the amount of pay for a regular hour.

Direct-Hire Employment

Often referred to full-time or permanent employment, direct hire candidates are employed directly by the hiring brand or business with the help of the staffing agency. These employees are carried on the hiring company’s payroll, paid a fixed annual salary, and offered the company’s benefits package. Staffing firms are used in this process to make the match, however, the offer letter and onboarding process are managed by the brand directly. A typical workweek is defined as 40 hours and oftentimes overtime worked does not result in additional pay though this varies depending on local legislation.

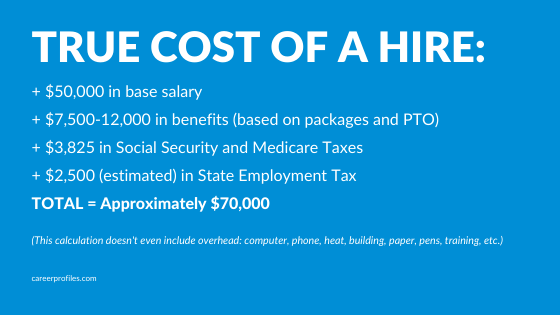

When a company is determining whether to hire a contractor or a direct hire employee, it often comes down to more than just your hourly wage or annual salary. For example, if a company hires you and offers a $50,000 salary for a direct-hire position, it actually costs almost 20% more to employ you. Let’s break down the financial difference between independent contractors and direct hire employees.

Key Differences Between Independent Contractors and Direct Hire Employees

Taxes and Headcount

Did you know that companies are required to match your social security and Medicare tax dollar for dollar? It’s expensive to hire a person as a full-time employee.

Then there’s the dreaded word, “headcount”. When dealing with any public company, it is critical that they prove to their investors that they have maximum productivity using the least amount of employees. This is because employees are considered the most expensive cost to any company, and the most risk. Companies address these costs by hiring long-term contractors. When engaging a professional, a contract staffing agency takes on the risk, finances the employees’ benefits, and matches all taxes.

Contract-to-Hire Possibility

Working as a long-term contract is a great way to get your foot into the door of a large, desirable company. Contract positions often convert to full-time, direct-hire roles. It provides both the company and contractor the opportunity to make sure they are the right fit for each other and allows the contractor to shine in a competitive job field.

Working With Profiles

As you are looking for your next dream job and targeting major corporations, consider working on a contract vs. a direct-hire basis. You have options, especially working with a staffing agency. Profiles marketing and creative tech recruiters can help guide you through the process of finding your first or next contract opportunity.

Profiles is a leading creative and marketing staffing agency dedicated to connecting top talent with industry-leading companies. Since 1998, we specialize in providing tailored staffing solutions that drive success and growth. Our team of experts is committed to delivering exceptional service and insights that help businesses and professionals thrive in the dynamic landscape of creative, marketing, and technology. Through our deep industry knowledge and client-centric approach, we ensure that both talent and organizations achieve their full potential.